Is life Insurance Haram? No, it is not Haram in Islam to have life Insurance. If the person whom the insurance company insures receives the amount committed to insure him against illness or any incidents, then there is no problem with life Insurance. source: sistani.org

Is life Insurance Haram?

According to Ayatollah Sistani, life insurance is okay in Islam if certain conditions are met. If someone pays money for life insurance and the company promises to help if they get sick or have an accident, it’s fine. Also, the insurance contract can include a clause where, at the end of the insurance period, the company gives back the same amount or more than what was paid.

In Islam, certain actions are considered halal (permissible) while others are haram (forbidden). But what about life insurance? Let’s break it down.

Question 1: Imagine a Muslim sets fire to his insured house on purpose, hoping to get money from a non-Muslim insurance company. Is this okay? Answer: Nope, it’s not okay. Destroying property and lying to the insurance company is a no-no. The money received from such actions isn’t lawful.

Question 2: Can you trick insurance companies in non-Muslim countries if it won’t make Islam look bad? Answer: Still a no. It’s not allowed.

Question 3: Say a Muslim in the West lies about their driving history to get cheaper insurance. Is this alright? Answer: Nope, lying for insurance discounts is a big no-no. Helping someone do it is also wrong.

Question 4: Is life insurance allowed? Answer: If you pay money for life insurance and the company promises to help if you get sick or have an accident, it’s okay. You can even ask them to give back the money later.

Source: Sistani.org

In Islam, the idea of managing risks through insurance raises questions about faith and responsibility. Some argue that insurance, like “Conventional Insurance” in Islam, is Haram because they are involved in unlawful ways to earn money. However, it is permissible to have Takaful Insurance, where members pool resources to help each other in times of need.

In the early days of Islam, communities supported each other in times of crisis, demonstrating a collective responsibility for each other’s well-being like Takaful Insurance. This spirit of mutual aid is cherished, but people turn to insurance for protection in today’s world, where communities may not function as smoothly as in Western countries.

Ultimately, the debate around insurance in Islam revolves around ensuring that the system benefits all members fairly and adheres to Islamic principles of cooperation and responsibility. Whether through traditional insurance, alternative models like Takaful, or community-based solutions, the goal is to provide support while upholding religious values.

Can Muslims own life Insurance?

Yes, Muslims can own life insurance, but it depends on the type of insurance and the organization offering it. Traditional life insurance may be considered haram because it includes elements prohibited by Islamic law, such as uncertainty, gambling, and interest.

However, some Islamic scholars permit term life insurance to ensure family financial security. Term life insurance may be halal if it doesn’t have an investment component. Or if the insured person doesn’t know about the investment component of that company, it will be permissible for him or her to have it. Whole life insurance may be halal if the investments are Shariah-compliant.

Why is interest haram in Islam?

In Islam, it is strictly forbidden to give or take interest, which is called riba, because it’s unfair and risky. interest is like a game where one person always loses. Interest lets rich people keep getting richer from the money of those who have less. When interest rates are high, it makes it hard for poor people to pay back loans, which makes them even poorer. So, in Islam, we avoid riba to protect people, and society from financial harm.

In Islam, we believe that even very low interest rates aren’t fair because they can make the lender lose money. So, interest doesn’t lead to fair sharing of money. Any deal with interest ends up hurting one person, which is like taking a risky chance, and that’s not allowed in Islam.

Is it haram to get a student loan?

All the Islamic scholars have said it to be Haram in Islam to take education loans. It’s not okay to take a loan from a bank if they ask for extra money back in return, which is called interest. That’s considered Haram in Islam, even if you have someone to vouch for you or not. However, receiving money from the bank is okay without thinking of it as a loan.

After getting permission from a Marja (religious leader) or their representative, you can use the money however you need. It doesn’t matter if you know the bank will make you pay interest later. But when the bank asks you to pay with interest, you should give it to them. Source: Sistani.org

Ayatollah Sistani’s ruling on getting the student loans from the government, with the conditions that:

1- You only need to start paying the debt after you graduate.

2- You only pay something once your income goes over a certain threshold.

3- It only covers the tuition fee and not maintenance, e.g., cost of living.

4- After 30 years, the outstanding balance will be written off, regardless of how much is left.

5- Interest accrues from the government’s first payment to the university.

Getting a student loan through UCAS is okay, but you must refrain from paying it back with extra money, like interest. You intend to use the loan to continue your education.

You still have to follow the loan rules and pay it back according to what they say.

All Shia students in the United Kingdom do this process without any problems.

Here’s the answer from Sayed Sistani’s website:

Taking a loan with interest is not allowed except in very urgent situations. In that case, you should do it with the intention that it’s a loan without extra payment, even if you know you’ll end up paying back the original amount plus interest. And you shouldn’t do it with the intention of accepting the loan with the condition of paying interest.”

Is Takaful Islamic Insurance?

Yes, Takaful is Islamic insurance. It works by people coming together to help each other during tough times, like accidents or illnesses. Instead of paying premiums to a big insurance company, members contribute to a fund. When someone needs help, they can get money from this fund.

Takaful Insurance follows Islamic principles, making sure everyone is treated fairly and no one profits unfairly. It’s like a community coming together to support each other, just like how people helped each other in the early days of Islam. Takaful is seen as a way to protect each other while staying true to Islamic beliefs.

Life Insurance in case of need

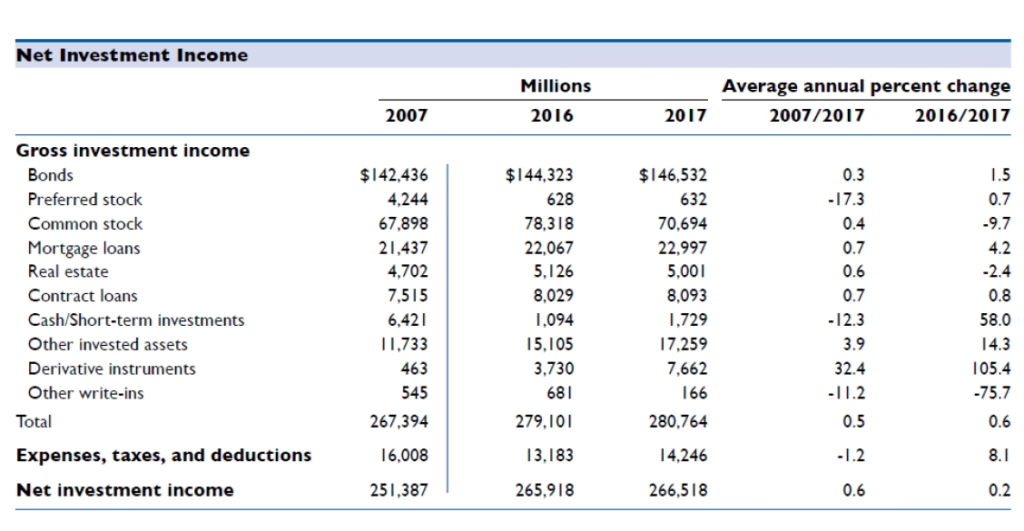

Life insurance companies invest the money they get from premiums in different places, like stocks, bonds, and accounts that earn interest. They have a big responsibility because they’re handling other people’s money. So, they try to avoid risks. That’s why they mostly invest in bonds, which are loans to governments or companies.

Life insurance companies have to pay out money over a long time, so they prefer safer investments like corporate bonds that last for 30 years.

But even though they invest a lot in bonds, they don’t make as much money from them as you might think. Only 52% of their total investment income comes from bonds. Bonds are considered not allowed in Islam because they involve interest.

Some other things they invest in, like mortgage loans, derivative instruments, and preferred stock, are also not allowed in Islam. And even though they invest in common stocks, it’s not clear if they’re following Islamic rules when they do.

In Europe, there are similar investment schemes tied to bonds.

Without this money from investments, they wouldn’t have enough to pay out later on.

Conclusion

I advise everyone who is young and considering taking out education loans. Do so with proper risk calculations and proper research of every loan provider in your option, and try to negotiate with the banks as much as possible.

In Islamic law, necessity means facing severe harm or danger to one’s life or basic needs, either for oneself or others. This harm must be very likely or certain unless action is taken to prevent it. It’s important to understand that necessity differs from simply meeting one’s needs.

For example, feeling very hungry doesn’t mean one will starve immediately, but it’s a need to eat. However, if hunger continues to risk harm or death, it becomes a necessity to eat, even if the food is usually forbidden.

Sometimes, scholars need proper conditions to use the law of necessity. There are essential principles to this law. One is that invoking necessity must align with Islamic principles. For example, preserving wealth is a goal in Islam, but does Islam allow doing forbidden things to protect or ensure wealth?

This is an important question when it comes to financial matters. It’s crucial to distinguish between what’s permissible and what’s not in such situations.